MiCA : What change for CASPs in 2024 ?

25 janvier 2024

MiCA Regulation was definitely adopted and published in the EU Official Journal on June 9, 2023, it establishes a unified European framework for crypto-asset markets outside the scope of traditional finance rules. This crypto-asset specific approach is unique, as most countries willing to regulate this market apply traditional finance regulations (such as in the US).

Among other things, MiCA sets out a new regulatory framework for crypto-asset service providers (so called “CASPs”), with sanctions ranging from bans on members of management bodies to fines of up to 15% of annual sales.

WHO ARE “CASPS”: FROM CUSTODY SERVICES TO INVESTMENT ADVISORS

The aim of the regulation is to cover a majority of players with a technology-neutral approach. CASPs are legal entities whose profession consists in providing one or more crypto-asset services to customers or investors, including, among others:

- The custody and administration of crypto-assets (i.e., the safekeeping or controlling of crypto-assets or of the means of access to such crypto-assets);

- The operation of a crypto-asset trading platform (marketplace);

- The exchange of crypto-assets (to fiat or crypto);

- The execution of crypto-asset orders on behalf of clients;

- The provision of advice on crypto-assets;

- The provision of crypto-asset portfolio management services;

- The provision of crypto-asset transfer services on behalf of customers.

HOW TO COMPLY WITH MICA

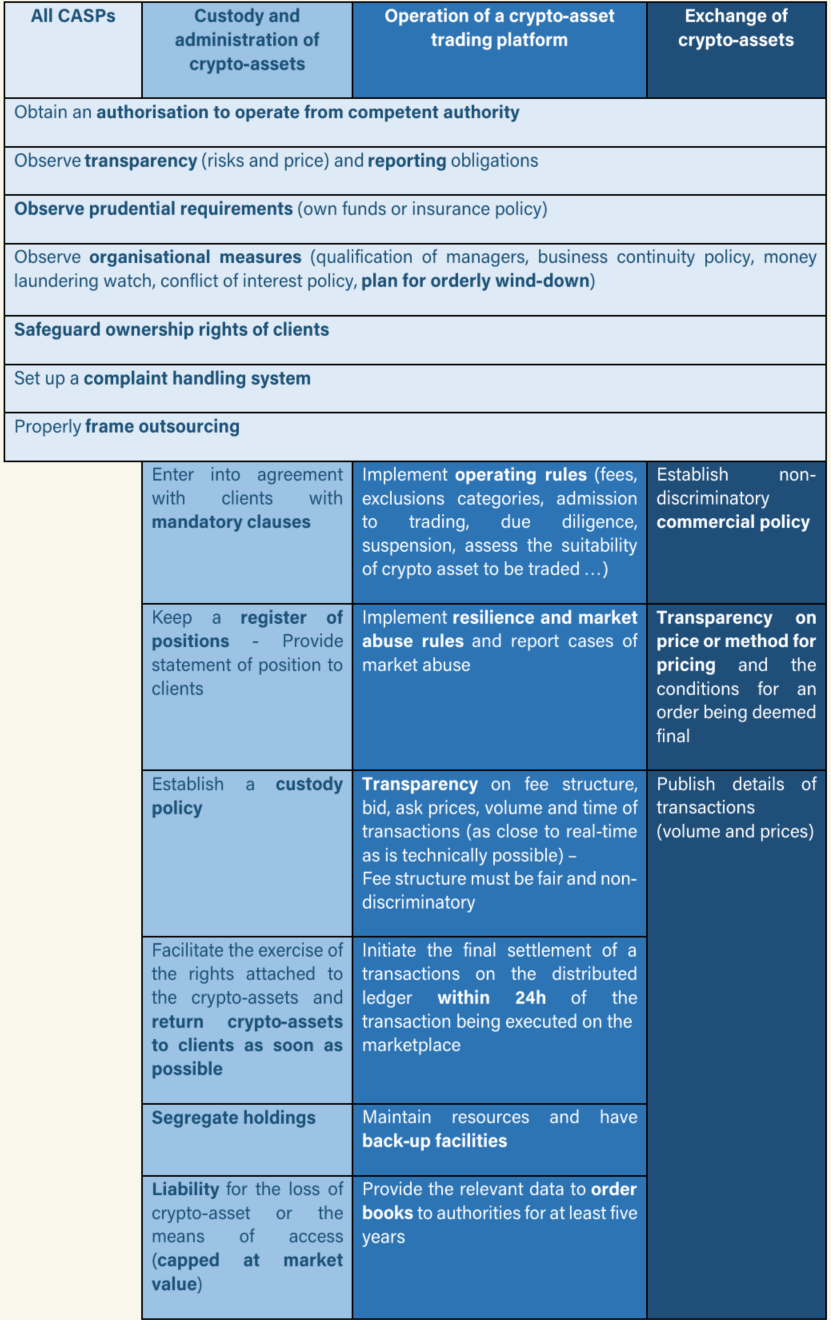

MICA follows a tailor-made approach with a common set of obligations applicable to all CASPs, supplemented by obligations depending on the services provided. The main obligation being to register with a European authority and obtain an authorization (or license) to operate and provide crypto-assets services in the European Union.

The table below summarizes the obligations applicable to all CAPS as well as the obligations applicable to CASPS providing custody, trading or exchange services.

WHAT TO EXPECT IN THE COMING MONTHS

MiCA Regulation will fully be applicable from December 30th, 2024. Before this deadline:

- CASPs must obtain an authorization to operate from their competent authority (in France the AMF) for the services they provide by June 30, 2024;

- CASPs that have already obtained an authorization to operate with a competent authority before December 30, 2024, benefit from an additional period of transition, until July 1st 2026 (after this date they will still have to apply for a new authorization).

Late 2023, the European Securities and Markets Authority (ESMA) has submitted for public consultation several draft delegated acts to specify the implementation of certain provisions of MiCA, and in particular the content and form of the application for the authorization to operate. A third consultation on delegated acts is expected early 2024. These delegated acts, including the format required to apply for an authorization to operate in the European union, are due to be finalized in the coming months.

Overview by Julie Carel, Laure Meysonnet and Emma Balzarini : click here